Finance minister Ericah Shafudah said Namibia anticipates an improved performance in several domestic revenue streams, highlighting that the country’s value added tax (VAT) is expected to rise by N$2.6 billion.

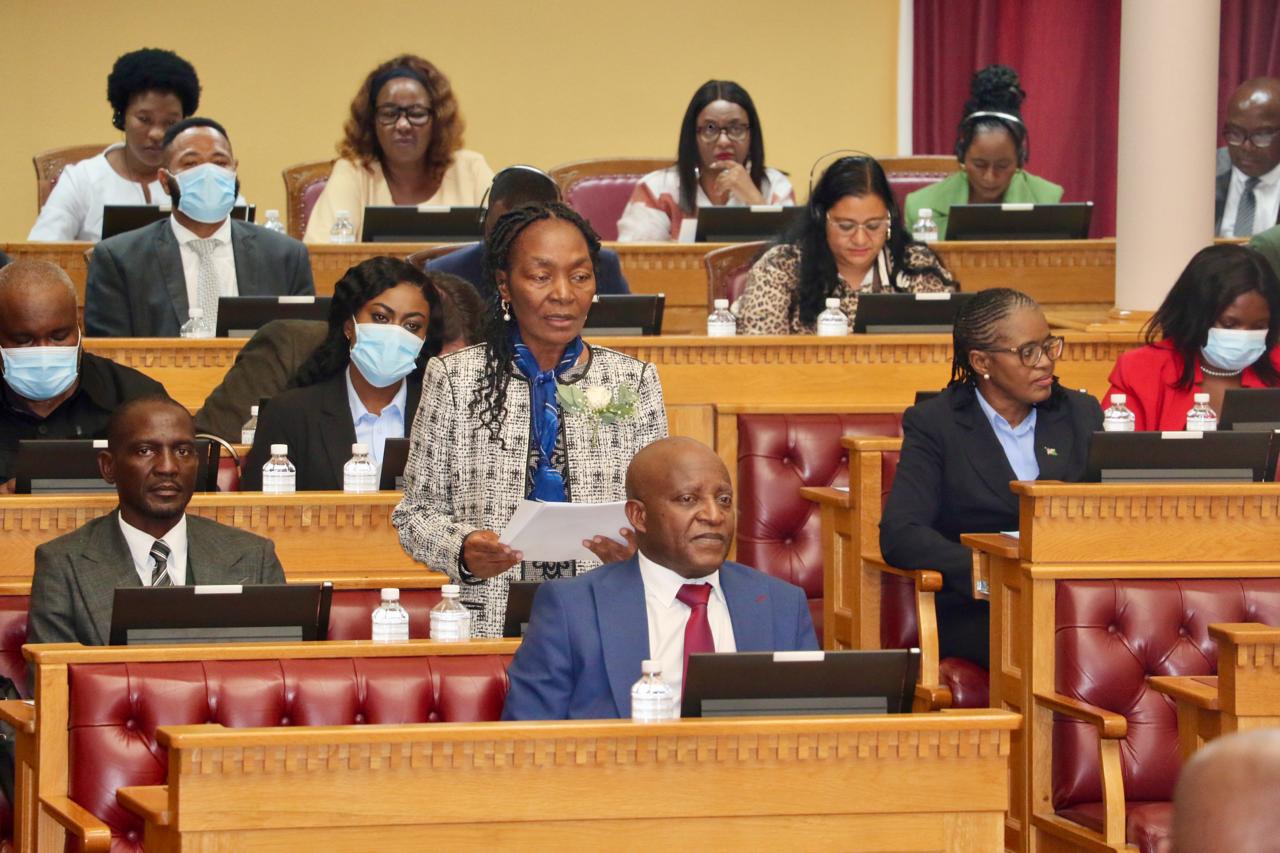

While presenting her maiden budget in parliament on Thursday, Shafudah indicated that the revised estimates for the 2024/25 financial year suggest that income tax on individuals is projected to increase by N$1.8 billion, while non-mining company taxes are estimated to rise by N$1.3 billion over the same period.

The minister also said the government has postponed the utilisation of N$1.6 billion in dividends from Namibia Post and Telecom Holdings, following the dissolution of the company, until the 2025/26 financial year.

“In addition, roughly N$450 million from the sale of the remaining 9% shares in the Mobile Telecommunications Limited (MTC) have been shifted to the next year’s estimates,” she noted.

Additional dividends to the tune of N$720 million are also anticipated from the Bank of Namibia.

Despite the budget being presented in a very challenging fiscal environment, Shafudah said the country has experienced notable headwinds, which have significantly constrained the available resource envelope during the 2025/26 financial year.

According to her, this has resulted in an estimated total revenue of N$92.6 billion for the 2025/26 financial year, a modest increase of only 1.9% from the revised estimates of the previous year.

“The substantial strain on revenues emanated from a N$6.9 billion reduction in Southern African Customs Union (SACU) receipts, which are confirmed at N$21.1 billion,” the finance minister said.

According to Shafudah, revenue growth is projected to average 5.2% over the Medium-Term Expenditure Framework (MTEF) period, breaching the N$100 billion mark by the 2027/28 financial year.

“Furthermore, moderate increases in SACU revenues and several domestic revenue streams have been considered in line with the postulated growth context. Overall, we project revenue as a ratio of GDP to remain strong, averaging 32.0 per cent over the MTEF,” she noted.

The minister further said that while the government has made every effort to adopt a conservative approach in its forecasts, considering potential downside risks, the revenue outlook remains subject to significant uncertainties, particularly in the global economy.

“Nevertheless, we remain committed to managing government finances in a prudent manner that ensures long-term fiscal sustainability through achieving sustainable budget deficits and public debt,” added Shafudah.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!